It seems like we just can’t stop talking about the pandemic and its effect on commerce. In the retail universe, it’s a bit like the big bang, complete with cascading ripple effects, like the massive shift to eCommerce that gave certain retailers a massive advantage. Sure enough, retailers are leveraging their massive online traffic to attract advertising revenue. It’s called retail media, and retailers are increasingly taking part, creating pockets of digital real estate on their websites and turning customer data into shopper-access packages and insights.

Now that retail media is part of the advertising and marketing mix, many advertisers are wondering if it’s right for them and how to use it. It’s a particularly timely question for home improvement brands on a fixed budget. Retail media is available at a variety of price points. So, how do you know which has the most value for you? How do you get started? How do you measure performance or decide on timing? Is retail media more effective than our own digital marketing? If any of these questions resonate with your brand, we’ve got answers. Read on and make sure you download our free Home Improvement Retail Media Guide.

How do Retail Media Networks Work?

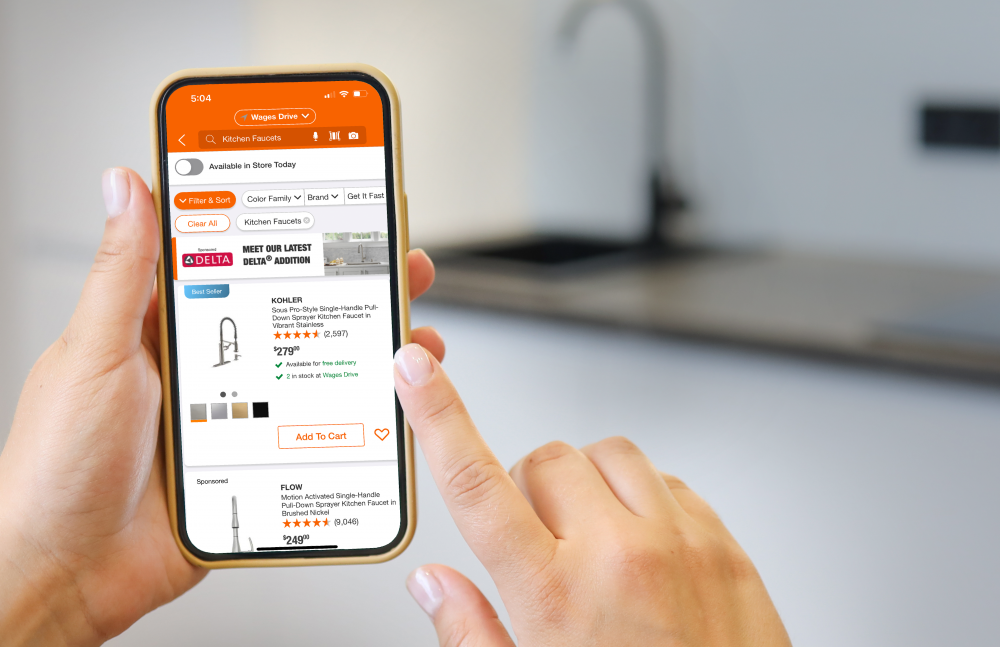

For anyone new to retail media, consider these examples: sponsored product ads, banner ads, social media ads, emails, and Google search ads. If you shop on Amazon.com, you’ll see retail media everywhere. As a digital-first retailer, Amazon has long understood the value of digital real estate. Meanwhile, home improvement retailers like Lowe’s and The Home Depot are quickly gaining speed and expertise in digital advertising. Their services are expanding and they have ROI you can’t ignore.

Retailers who sell digital advertising operate retail media networks, which vary depending on the retailer. For example, The Home Depot Retail Media+ offers solutions through on-site and off-site channels including, email, search and social media. Amazon Ads provides solutions that include ads on streaming platforms, audio platforms, Amazon-owned websites, and third-party websites. Meanwhile, Lowe’s One Roof Media Network offers on-site, search, and social media advertising.

The Benefits of Retail Media

Access to Valuable Advertising Space

If you’ve seen our blog on The Future of eCommerce, you’ll recall that we drew a lot of attention to the fact that homedepot.com ranks among the top eCommerce sites worldwide. In May 2022, it ranked 12th globally and 5th in the U.S., meaning that over 186 million people visited The Home Depot’s website in one month. For home improvement brands, that traffic is an incredibly valuable market.

Retail media is certainly a service that promises to take a bit of wind out of Google’s sails. If we consider the value of digital real-estate, think of retail media as an endcap inside The Home Depot store or in the aisle itself. You’re visible to an audience that is aware, interested and conversion-ready. Meanwhile, Google ads are more like billboards located on the interstate. Suppose you’re a faucet manufacturer with a product for sale at homedepot.com. Can you think of a better place to advertise your product than via promotional placement on the faucet category page?

On-Site and Off-Site Advertising

Retail media networks go beyond the lowest hanging fruit by offering on-site and off-site solutions. In addition, retail media capitalizes on first-party data to identify prospects and retarget shoppers. With access to this data, retailers are only limited by the scope of their network in tracking shoppers who share their data.

Most of us have experienced this prospecting and retargeting in action. If you’ve shopped online recently, you probably visited a few eCommerce pages before adding something to your cart or leaving the site. Consider the sponsored product ads that followed you along that journey, or the order in which products appeared as you searched categories. Think about the email you received from the retailer a few hours later, or the Facebook ad that popped up in your feed that night. How about the banner ads that followed you around the web for days and reminded you to complete your purchase? That’s retail media.

Increased Return on Ad Spend

Although retail media is amassing greater power for retailers, it’s also advantageous for brands. Think back to that sponsored faucet example, the one that appeared at the top of the page when you searched “faucet.” If you are the manufacturer of that product, you just leapfrogged the buyer journey. Just like that, you have cut through all the unqualified or uninterested shoppers, straight to the buyer who is shopping for a faucet. In brick-and-mortar terms, you are in the aisle with the shopper. You are also at the point of sale so that if they place that item in their cart, there is little ambiguity around attribution. When attribution rates increase, so does revenue over ad spend (ROAS).

Retail Media for Home Improvement Brands

While retail media for consumer-packaged goods is quickly expanding to include a wide range of media platforms, the home improvement retail media-verse remains relatively modest. At present, The Home Depot and Lowe’s appear to be sticking to more traditional channels like social, search and email. Within those channels, however, there is tremendous opportunity for brands who get on board. Here are a few simple objectives that every brand can take advantage of, no matter the size or budget.

First, Don’t Get Lost

It’s no surprise that national brands are taking advantage of retail media. After all, they have the budgets for it. As a result, national brands are leading search page results, while smaller brands are being pushed off the front page. Perhaps there’s a strategy argument to be made for brands who survive on the shoppers who sort by price, but for those who live in between, it’s now easier than ever to get lost. That’s particularly true with mobile shopping, where real estate and patience are especially limited.

Second, Invest What You Can

While some solutions can be expensive, retail media is not cost-prohibitive. Small to mid-sized retail brands should invest what they can and do all they can to support their investment. For instance, the entry-level investment for Sponsored Products is around $500. Keep in mind that if you invite shoppers to view your Product Page, it should be ready for traffic.

When it comes to pricing for retail media, remember that retailers can rent out the digital real estate that they own for less than ad space they buy from third-party sources. Which means that on-site advertising is less expensive than off-site. For example, the minimum investment for on-site Sponsored Products starts at around $500, while dynamic social media ads are nearly ten times that cost.

Third, Make Shopper Insights a Priority

As digital privacy evolves and the digital cookie becomes extinct, brands not investing in retail media will find it harder and harder to obtain shopper data at, or even near, the scale that retail media networks provide. And scale is the gateway to reliable shopper insights and access. Remember that homedepot.com and lowes.com receive approximately 6M and 4M daily visits, respectively. Even the best branded websites will have a hard time attracting that volume of traffic.

Meanwhile, with such massive amounts of data at their fingertips, retail media networks can offer sophisticated audience segmentation, allowing home improvement brands to target shoppers based on dozens of criteria, including specific interests, home ownership, and location. Feedback from this type of precise targeting can lead to insights that are as valuable as sales. Of course, targeting also helps boost sales.

Are You Ready for Retail Media?

Given the above information, we have to ask: if you aren’t pursuing a retail media strategy for your brand, what are you waiting for? With digital privacy laws changing and more and more consumers shopping online, the value of retail media is only going up from here. Maybe you aren’t sure where to start or how to get the most out of your investment. Maybe you aren’t sure how much you can afford or what’s the best approach for your goals. That’s okay. We can help. If you’re interested or just curious about retail media, give us a call.